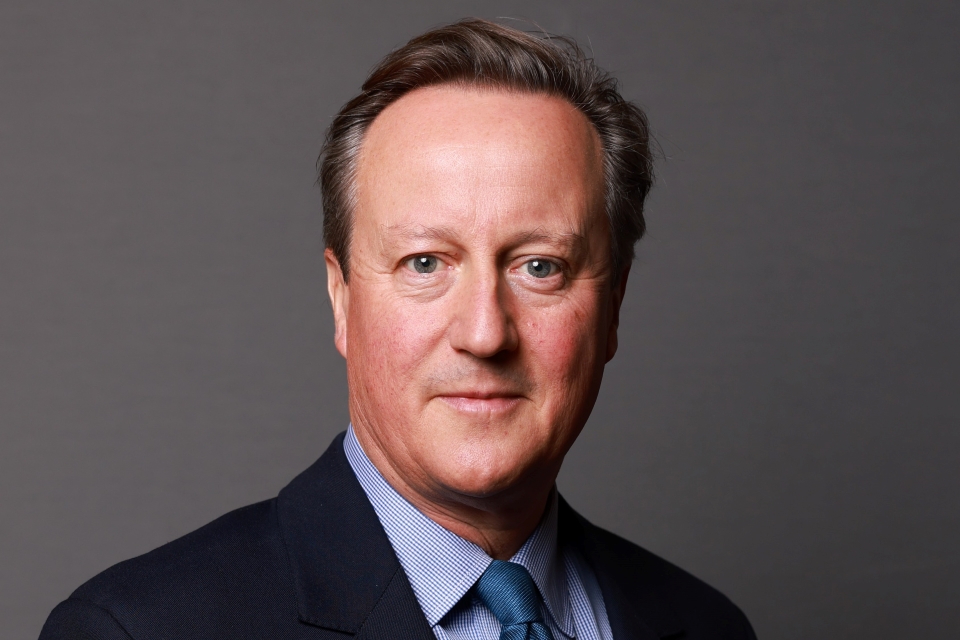

Prime Minister David Cameron's speech to the World Economic Forum in Davos

David Cameron sets out the main priorities for the UK's Presidency of the G8: trade, tax and transparency.

It’s the UK’s privilege to host the G8 this year and I want to set out today our main priorities. Now right up there on our agenda is of course tackling the threat of extremism and terrorist violence that we’ve seen erupt in Mali and in that despicable attack in Algeria.

I’ll put my cards on the table, I believe we are in the midst of a long struggle against murderous terrorists and a poisonous ideology that supports them. Just as we’ve successfully put pressure on al-Qaeda in Afghanistan and Pakistan, so al-Qaeda franchises have been growing for years in Yemen, in Somalia and across parts of North Africa, places that have suffered hideously through hostage taking, terrorism and crime.

Now to defeat this menace we’ve got to be tough, we’ve got to be intelligent and we’ve got to be patient, and this is the argument I’ll be making at the G8. Let me be again absolutely clear, there is a place for a tough security approach including at times military action where necessary. The French are right to act in Mali and I backed that action, not just with words, but with logistical support too. But we need to combine a tough security response with an intelligent political response. We need to address that poisonous narrative that the terrorists feed on. We need to close down the ungoverned space in which they thrive and, yes, we need to deal with the grievances that they use to garner support.

Now this means using everything at our disposal: our diplomatic networks, our aid budgets, our political relations, our military and security cooperation and yes, supporting - in those countries and elsewhere - the building blocks of democracy, like the rule of law and a free media. The Arab Spring remains part of the solution, not part of the problem.

Now I want to open up a new debate too in how we share the burden of meeting this threat. The G8 can help discuss how we can best divide up some of this work between us and how we can each individually partner-up with the countries worst affected to overcome this threat and, like I say, this is going to be right up there on our agenda for the G8.

But today I want to focus on our economic priorities, because for all the countries in the G8 and all the countries across the European Union there is a big, looming insistent question, and that is how do we compete and succeed in the global economic race that we are engaged in today.

How do we succeed when other nations are growing, changing, innovating so fast? Now a lot of the answers are clear. You’ve got to deal with your debts, you’ve got to cut business taxes, you’ve got to tackle the bloat in welfare, and crucially you’ve got to make sure your schools and your universities are truly world class.

Now back in the UK we’ve been doing all of these things. Less than three years in and this government has cut the deficit by a quarter; our corporation tax rate is the lowest in the G7. In welfare reform we’ve been radical, in education almost revolutionary - busting open the state monopoly of education and allowing new Free Schools to start up, and crucially to compete in this global race. We are making sure that the United Kingdom is more outward looking than ever before.

Now yesterday I gave a speech setting out the UK’s place in Europe.

This is not about turning our backs on Europe - quite the opposite. This is about how we make the case for a more competitive, a more open, a more flexible Europe and how we secure the UK’s place within it. This is how I see it. Just over half of the EU countries are in the single currency, in the Euro. When you have a single currency you move inexorably towards a banking union, towards forms of fiscal union and that has huge implications for countries like the UK who are not in the Euro and frankly [never will be] are never likely to join. The club we belong to is changing. We can’t ignore this: change is underway and the debate about what this means, it is live, it is happening right now.

And as I said yesterday consent in the United Kingdom for the steps that have already been taken is wafer thin.

Now some just say well let these events unfold naturally. I say no. We should try and shape them in the UK’s national interest. Let us negotiate a new settlement for Europe that works for the UK and let’s get fresh consent for it. And it’s not just right for the United Kingdom, it is necessary for Europe. Europe is being out competed, out invested, out innovated and it is time we made the European Union an engine for growth, not a source of cost for business and complaint from our citizens.

So I want the UK to look out, not in, and that is why for the first time in a decade UK foreign policy is on the advance. By 2015 we will have opened up twenty new diplomatic posts around the world, employed three hundred extra staff in the fastest growing regions of the world. We are having to make cuts in the UK, but this is something we are not cutting, we’re expanding. We’re now one of only three European countries to be represented in every single country in ASEAN and we have the largest diplomatic network in India of any developed nation. We are a global nation with global interests and a global reach, and if you think all of this is somehow an unashamed advert for the UK and UK business you’re absolutely right. Everything I do is about making sure we’re not just competing in that global race, but we’re succeeding in it.

But my argument today, the argument I want to make in front of you and the idea that the G8 will be driving forward this year, is that competing in the global race is not just about what we do at home, it is about the wider economy we’ll operate in, the rules that shape it, the fairness and the openness that characterise it. We need more free trade. We need fairer tax systems. We need more transparency on how governments and, yes, companies operate.

Let me tell you why. It’s the oldest observation of the modern age that we are all interconnected. Communication is faster than ever, finance is more mobile than ever and yet the paradox of this open world is that in many ways it’s still so closed and so secretive. It’s a world where trade is still choked off by barriers and bureaucracy. It’s a world where some companies navigate their way around legitimate tax systems and even low tax rates with an army of clever accountants. It’s a world where, regrettably, corrupt government officials in some countries and some corporations run rings around the letter and the spirit of the law to rip off hard working people and to plunder their natural resources.

There is a long and tragic history of some African countries being stripped of their minerals behind a veil of secrecy. We can see the results: the government cronies get rich, some beyond their wildest dreams of avarice, while the people in those countries stay poor.

So it is clear how devastating this can be for some developing countries. But frankly all this matters, and should matter, to developed countries too. When trade isn’t free, we all suffer. When some businesses aren’t seen to pay their taxes, that is corrosive to the public trust. When shadowy companies don’t play by the rules, that drives more box ticking, more regulation, more interference and that makes life harder for other businesses to turn a profit. That is why I want this year’s G8 to bring a new focus on these issues: trade, tax, transparency. Those are the issues we are going to be driving for this year.

Trade

So first we’re going to push for more openness on trade. In late 2008 we saw the steepest fall in global trade ever and the deepest since the Great Depression, and more than four years on trade has still not fully recovered. Now this should be at the forefront of the mind of every leader, every diplomat during those long negotiations on trade; and there’s an enormous amount on the table today. You’ve got the US leading efforts on the Trans Pacific Partnership. In the European Union we’re about to embark on our biggest-ever programme of free trade agreement negotiations. We’ve got parameters for a deal with Singapore, negotiations with Canada nearly complete, and we’re about to launch negotiations with Japan, and of course there’s the beginning of negotiations on an EU-US trade deal. Now the EU and the US together, we actually make up about a third of all global trade. A deal between us could add over fifty billion pounds to the EU economy alone. Agreeing all the EU deals on the table could increase our GDP by two per cent and create over two million jobs across the European Union.

Trade between developing countries and within Africa is growing and we should work to encourage that further - and we must also continue to support the multilateral system. This means working through the WTO to agree a deal to sweep away trade bureaucracy at the ministerial conference in Bali this December. That alone could be worth around seventy billion dollars to the global economy and help trade to flow freely across the world. It is ambitious, but we must seize these opportunities to give a massive boost to free trade across the world.

Tax

Now the next T is tax. We want to use the G8 to drive a more serious debate on tax evasion and tax avoidance. This is an issue whose time has come. After years of abuse people across the planet are rightly calling for more action, and most importantly there is gathering political will to actually do something about it.

Again let me put my cards squarely on the table. Of course there is a difference between tax evasion and tax avoidance. Evasion is illegal. It can and should be subject to the full force of the criminal law. But what about tax avoidance? Now of course there’s nothing wrong with sensible tax planning and there are some things that governments want people to do that reduce tax bills, such as investing in a pension, a start up business or giving money to a charity. But there are some forms of avoidance that have become so aggressive that I think it is right to say these raise ethical issues, and it is time to call for more responsibility and for governments to act accordingly.

In the UK we’ve already committed hundreds of millions into this effort, but acting alone has its limits. Clamp down in one country and the travelling caravan of lawyers, accountants and financial gurus will just move on elsewhere. So we need to act together, including at the G8. If there are difficult questions about whether existing standards are tough enough to tackle avoidance we need to ask them. If there are options for more multilateral deals on automatic information exchange to catch tax evaders we need to explore them.

And we want to work with developing countries on this too. The fact is, the poorer the nation, the more they need the tax revenues - but often the weaker the capacity they have to collect them. But we must not let them off the hook; it can be done. The UK has worked with the Ethiopian authorities to help with tax collection, and in the last decade the amount of tax collected has increased by seven times. All of this in developed and developing countries alike comes down to a simple issue of fairness.

I believe in low taxes, that is why my government is cutting the top rate of income tax, we’ve cut corporation tax

Individuals and businesses must pay their fair share. And businesses who think they can carry on dodging that fair share, or that they can keep on selling to the UK and setting up ever more complex tax arrangements abroad to squeeze their tax bills right down, well they need to wake up and smell the coffee, because the public who buy from them have had enough.

And let’s be clear: speaking out on these things is not anti capitalism, it is not anti business. If you want to keep tax rates low you’ve got to keep taxes coming in - put simply: no tax base, no low tax case. You need to have that base in order to deliver the low taxes that businesses and competitive economies need. This is the argument that’s been made brilliantly by the economist Paul Collier and I’m delighted that he’s been advising my government ahead of this G8. This is about me and all the other G8 leaders being able to look our people in the eye and say that when they work hard and pay their fair share of taxes we will make sure that others do so as well.

Transparency

Now the third big push on our agenda is transparency: shining a light on company ownership, land ownership and where money flows from and to.

This is critical to developing countries. Of course aid has played, and will continue to play, an important role in development, and I’m proud that the UK is keeping its aid promises. I’m also proud that we are leading the fight on global hunger, funding nutrition programmes for twenty million children and pregnant women over the next few years.

There should be, there will be, and I will back a major push on tackling global hunger, under-nutrition and stunting this year. And I applaud the NGOs, the charities, the organisations that are motivating public opinion, business opinion, world opinion on this absolutely vital issue.

But at the same time as talking about aid we also need to move the debate on so we’re not just dealing with the symptoms of poverty but we’re tackling the causes. Now I’ve argued for years that there is a golden thread of conditions that enable open economies and open societies to thrive. The rule of law, the absence of conflict and corruption, the presence of property rights and strong institutions: these things are vital for countries to move from poverty to wealth.

And now as the co-chair of the UN High Level Panel, and with the presidency of the G8, there is a chance to put turbo boosters under this agenda, and I’m determined to seize that chance.

I want this G8 to lead a big push for transparency across the developing world, and to illustrate why let me give you one example. A few years back a transparency initiative exposed a huge hole in Nigeria’s finances, an eight hundred million dollar discrepancy between what companies were paying and what the government was receiving for oil - a massive, massive gap. The discovery of this is leading to new regulation of Nigeria’s oil sector so the richness of the earth can actually help to enrich the people of that country.

And the potential is staggering. Last year Nigeria oil exports were worth almost a hundred billion dollars. That is more than the total net aid to the whole of sub Saharan Africa. So put simply: unleashing the natural resources in these countries dwarfs anything aid can achieve, and transparency is absolutely critical to that end. So we’re going to push for more transparency on who owns companies; on who’s buying up land and for what purpose; on how governments spend their money; on how gas, oil and mining companies operate; and on who is hiding stolen assets and how we recover and return them. Like everything else in this G8, the ambitions are big and I make no apology for that.

Thirty years ago more than half of our planet lived on the equivalent of one dollar twenty five a day or less; today it’s not one half, it is one fifth. This is an amazing story of human progress and it shows what is possible. We can be the generation that eradicates absolute poverty in our world, but we’ll only achieve that if we break the vicious cycle and treat the causes of poverty and not just its symptoms.

So let me end today by saying this: I know that some people might be thinking he’s talking about cracking down on tax avoidance, talking about making companies be more transparent - doesn’t this sound like an anti-business, bash the rich, tax success agenda? Absolutely not. This is a resolutely pro-business agenda. I’m about the most pro-business leader you can find. I yield to no-one in my enthusiasm for capitalism.

It is an economic system that generated more wealth, unleashed more human potential and reduced more grinding poverty than any other in history. I don’t believe that one person’s wealth fairly gained through free exchange in an open market is somehow the cause of another person’s poverty. I will have no truck with those who want to demonise the successful, to level down rather than to build up, or to those who seek continually to turn the word profit in to a dirty word.

But I also passionately believe that if you want open economies, low taxes and free enterprise then you need to lay down the rules of the game and you need to be prepared to enforce them. Poor business practice doesn’t operate in a vacuum: it hurts the good. When one company doesn’t pay the taxes they owe then other companies end up paying more. When some cowboys play the system all businesses suffer from the fallout to their reputation - that is why it’s not just those in the NGOs who’ve been lobbying my government on these issues, it’s those in the high rises in the City of London: bankers, lawyers, senior figures in finance. They’ve told us to pursue this agenda hard and that is exactly what we’re going to do.

This is a vision of proper companies, proper taxes, proper rules. A vision of open societies, open economies and open government and we are going to work with our partners in the G8 to achieve it for the good of the people right across the world. Thank you very much indeed for listening.