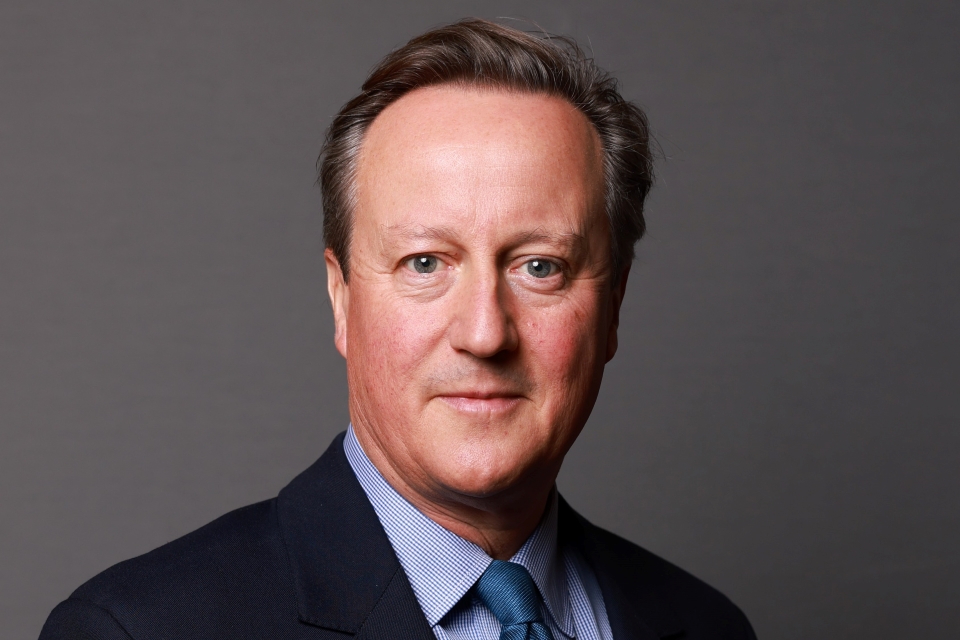

Prime Minister's speech on exporting and growth

"We need this to be a country where more people think 'I start my own business and I can sell to the world'."

Introduction

We’re here to talk about exports, but let me first of all talk about one of the imports I’m most proud of. People ask: “Why can’t we get a top business leader into politics?”

Well in Stephen Green we have a brilliant one.

Right at the heart of everything, we are doing to boost our exports and drive new investment into Britain. There couldn’t be a better person for the job. And I am very pleased to be here today to support what Stephen is doing.

We meet at an alarming time for the global economy. Markets are incredibly volatile. The Eurozone is in crisis. And as a result our economy faces new difficulties.

People are worried about their jobs. Businesses are feeling the strain. And I don’t for one minute under-estimate the difficulties we face in the months ahead.

We need a laser-like focus on helping businesses, creating jobs and helping families. But while this is a time of difficulty, it’s also absolutely the right time to try and fix long-standing weaknesses that have held us back for decades.

One of these weaknesses is what I call our twin deficits: a deficit in our budget and a deficit in our trade.

I’ve talked a lot about getting to grips with the first. Today I want to talk about fixing the second. Because the point is that there is growth in the world economy. Not in the Eurozone, but in huge modern cities from Bogota to Istanbul.

There are new markets and new consumers. People hungry for the skills and services Britain is best at.

The fact that we export more to Ireland than to Brazil, Russia, India and China combined shows just how reliant we are on Europe and how much opportunity there is for us to grasp in these emerging economies. And I say this is the time to get out there and sell to them.

Of course, there are some who believe this is all too difficult. So today I want to meet head-on three of the biggeset challenges we face.

First the challenge from those who say we don’t make enough, so we can’t export and we can’t deal with our trade deficit.

Second the challenge of regulation and bureaucracy and the sense that it is only going one way - and that is getting worse.

And third the challenge of helping small businesses to get finance at a time when banks are deleveraging.

Let me take each in turn.

Exports

First, exports.

As I’ve said before, the economy needs to be rebalanced. We need more manufacturing, more technology, more aerospace. But we have a good base from which to build.

Here at BFI IMAX, I’m delighted to learn that the BFI has this week set up a £200,000 export fund to help British film companies to sell their films abroad. And I can announce today, that the film tax relief will be extended to the end of 2015 guaranteeing hundreds of millions of pounds of support for the British film industry.

It’s not just the film industry where Britain is excelling.

We’re selling tea to China, vodka to Poland and cheese to France. There’s a baker in Dunstable selling naan bread to India.

Fracino in Birmingham sell coffee-makers to Italy. There’s even a firm in Anglesey selling canoes to the eskimos.

British SMEs are already doing incredible things. And we urgently need more of them to follow that boldness.

Let me give you another extraordinary fact.

Increasing the number of SMEs that sell overseas by 100,000 has the potential to add £30 billion to the UK economy.

In other words, if we boost the number that export from around one in five to over one in four we could pretty much wipe out the trade deficit. And create around 100,000 jobs.

This is the prize we’re going for. Ambitious, I know, but we can do it. As we sell more, let’s remember our advantages:

The English language. The easiest access to the biggest single market in the world. 500 million consumers generating 12 trillion euros in economic activity. And coming up next summer, we’ve got the biggest marketing opportunities Britain has had for a generation, in the 2012 Olympics and the Diamond Jubilee.

That’s why I’ve been loading up planes with British businesspeople and taking them to India, China, Russia, Turkey, South Africa and Nigeria. And the Deputy Prime Minister has been doing the same - in Brazil and Mexico.

It’s why at the G20 last week I pushed for agreement on new and credible approaches to trade liberalisation. Breaking down trade barriers and opening up new markets. And it’s why I’ve come here today with a very clear message to Britain’s small and medium sized businesses: we need more of you to get out of your comfort zone and get selling to the world.

We’re changing our own attitude in government, so if we’re taking a delegation abroad to strike trade deals. It won’t just be the big blue chip companies that get invited but small ones too.

We’re refocusing UKTI so it’s more about actively helping small and medium-sized businesses. And UKTI is working with Yell to develop an online service called Open to Export which will provide SMEs with access to more information, advice and support from intermediary organisations like many of you here today.

And because going global means going online, we’re getting behind schemes like the fantastic Web Fuelled Business that’s launching today with workshops for 3,500 businesses all over the country to get them online.

I know there are concerns about the Bribery Act. That’s why I paused its implementation to make sure it was as friendly to business as possible. But now we’ve got it, let’s make an advantage of it.

People can trade with us knowing that British business is clean business. So this is what Government’s doing.

But we’ve got you here today - lawyers, accountants, bankers, advisors, investors - because you’re the ones who deal with SMEs day-in, day-out.

You’re the ones who can convince them of the clear business case for trading overseas: the boost to profits; the increase in productivity; the resilience you get from diversifying your markets.

You’re the ones who can tell them about the opportunities on offer to help them do that. And you’re the ones who need to tell us what more we can do to drive up exports, get behind small businesses and trade our way to strong growth.

Deregulation

The second concern I hear from businesses around the country is that regulation only goes one way.

The reality of any government - of any political colour - is that more than twenty people sit around the Cabinet table and only the Chancellor and the Business Secretary are programmed to be consistently in favour of deregulation.

All the others have proposals for regulation coming through from their departments, whether it’s promoting health and safety or protecting the environment. This government has turned that on its head.

We’ve dealt with the flow of regulation by instituting a “one-in-one-out” rule, so any Minister who wants to bring in a new regulation, has to get rid of an existing one first. And we’ve imposed a moratorium on all new regulations for microbusinesses. And we’re dealing with the stock of regulation too.

Our growth review process asked all Ministers to consider ideas for deregulating.

And with the Red Tape Challenge, we are asking everyone - from the one-man-band to the multinational - what regulations need to change or go.

Today I can announce we’re expanding the Red Tape Challenge, so it doesn’t just cover the red tape that affects businesses today, but the businesses of tomorrow too. Because we’ve heard from start-ups that they’re innovating so fast, their innovations are out-stripping the regulation that currently exists.

At its simplest deregulation has got to be about making it easier to start a business and making it easier to employ people. And I’m determined to do both.

We want Britain to be the fastest place in the world in which to start a business. And yet currently it’s quicker to set up a business in Rwanda than it is in Britain.

We can’t go on like this.

So on starting a business, we’re going to reduce the costs of setting up a business with something called “one-click registration.”

From next April if you want to start a business there’ll be no more filling in endless forms, giving out the same information over and over again. You’ll be able to get online, set up your business and register for taxes - and see the taxes that you’ve paid and that you owe - all in one place.

And when it comes to making it easier to employ people, we are going to get to grips with some of the rules and regulations designed to protect employees, but which are actually stopping people getting jobs in the first place.

Too often a criticism of regulation and bureaucracy is confused with an attack on the rights of employees. It’s seen as some sort of choice.

Either we’re on the side of business or on the side of the people; backing management or backing employees. In other words, too many people think you strip away the rights of employees in order to give businesses an easier life.

This couldn’t be further from the truth. We want businesses to create jobs.

But if employers are so concerned about the prospect of being taken to tribunal that they don’t feel they can have frank conversations with their employees many companies just won’t feel able to create those jobs in the first place.

One businessman said he didn’t have the time or the money to go through the hassle of removing people in the UK - so he hires in the US. Another said “I don’t care if the UK’s processes are more flexible than most European countries. That’s like saying we’re better than Italy at cricket. The real competition is the US and Asia.”

That’s why I want to deregulate and cut back on bureaucracy. Not simply to help business but to create fair, simple processes that are good for business and good for employees too.

So we will be consulting on the introduction of protected conversations, so a boss and an employee feel able to sit down together and have a frank conversation - at either’s request. And we’re going to help address employers’ fears of a tribunal by increasing the qualifying period for unfair dismissal claims from one year to two years from next April.

This means anyone taking on a new employee can now be confident that they have two years to get the relationship right, rather than just one. And if things aren’t working out then they can end the relationship without being sued for unfair dismissal.

We’re also proposing to introduce fees for individuals who want to bring cases to employment tribunals, meaning that potential claimants are much less likely to pursue this option unless the employer has a genuine case to answer.

Finance

Third, finance.

All over the world banks have been badly damaged. They’ve had to repair their balance sheets and that means they are often not lending as much as the economy needs.

We’ve got to get the banks back to good health and proper lending. And we’re not going to do that with a permanent state of warfare between politicians and bankers.

So we sat down with the bankers and said if you lend more to small and medium sized businesses, pay fewer and more transparent bonuses and fund the big society bank we’ll stick with the bank levy and not add to it. But we need to go further than that.

A year ago we created something called the Regional Growth Fund. Sounds like jargon I know. But let me tell you the difference it is really going to make.

It’s getting private sector investment into parts of our country that are over-dependent on the public sector. So far £1.4 billion has been allocated to projects from Plymouth to Newcastle unlocking nearly £8.5 billion of new private sector investment and potentially creating or safeguarding 325,000 jobs.

That’s great. But what about the small businesses?

I’ve lost count of the number of times people working in our small businesses have told me they just can’t get a loan for that new investment, that new clean room or that extension to their business.

Often it’s a small investment - maybe just £30,000 - that can create the jobs and kickstart the innovation and exports that we need. But these are the very loans that you simply can’t get without personal guarantees, like putting up your house - and even then the banks might say no.

That’s got to change - and we’re going to use the Regional Growth Fund to help change it.

So Lord Heseltine has brokered a ground-breaking deal with RBS and HSBC where the Government will provide £95 million of new Regional Growth Fund money for small and medium sized businesses and these two banks will administer the scheme and provide new lending, unlocking a total of £500 million of new investment for small and medium sized businesses.

By working with high street banks like this we will give support to those SMEs that can’t access commercial funding and we will help areas of our country that other forms of business lending can’t reach.

That’s great news for small businesses, great news for local communities and a great example of how banks are stepping up to the challenge of getting our economy moving.

It’s a huge step forwards. And that’s not all. There’s more.

We have persuaded the banks to do their bit through something called the Business Growth Fund. What does that mean?

It means there’s a fund of £2.5 billion set aside by the banks which is going to be used to help businesses with a turnover between £5m and £100 million. This is a long term initiative to meet a real structural gap in funding for fast growing businesses.

It is not a short term fix. For the past six months the fund has been recruiting a highly experienced investment team and opened offices across the UK. They announced their first two investments last month, and there are lots more to come.

When they are fully up to speed they should be making around 40 big investments every year. This is a huge sum of money that can have a big impact in our economy. And we’re not going to stop there.

We also need to be supporting the person who wants to start that small internet trading firm from their home:

The plumber who sees the chance to start a business fitting green energy to people’s homes. The people out there who are brave enough to make a break and go for it.

So over the coming weeks we are going to look at the whole range of options to improve the ability of companies to borrow or access funding - including, for example, through credit easing.

So I want everyone in this hall to take the message out from here that these funds are available to SMEs:

The ones who’ve tried and failed to get credit, the ones with no trading history, the ones with no collateral to put up against a loan.

There are billions of pounds waiting in banks and in other investment funds. The money is there now.

So let’s get great British businesses tapping into it.

Conclusion

We need this to be a country where more people think ‘I start my own business and I can sell to the world.’

There is so much untapped potential in the people of Britain - and that particularly goes for the women of Britain.

We know that if women were setting up new businesses at the same rate as men we would have 150,000 more start ups in the UK each year. We’ve got to help overcome that gap between dreaming about being an entrepreneur and becoming one.

Back in March I launched Start Up Britain - a new movement by entrepreneurs for entrepreneurs, where the people who really know - the people who do business - offer the very best in support and advice for those who want to start-up a business. It’s gone from strength to strength since then.

We will be backing Start Up Britain further in the months ahead to inspire the can do culture we need in this country. And I hope that Britain’s big businesses will do all they can to help make Start Up Britain a success.

So I hope today I’ve managed to persuade you of our ambitionto see 100,000 more SMEs exporting, and to make this the easiest place to set up and run a small business.

Our determination to come through these difficult times stronger, to trade our way to growth and jobs. And our openness to working with people like you, to make all this happen.

We need to show real optimism about the future. And we need to show real aggression about pursuing Britain’s interests in the world.

The markets are there to be tapped. The deals are there to be done. The opportunities are there to be capitalised on. Now together we must seize them.