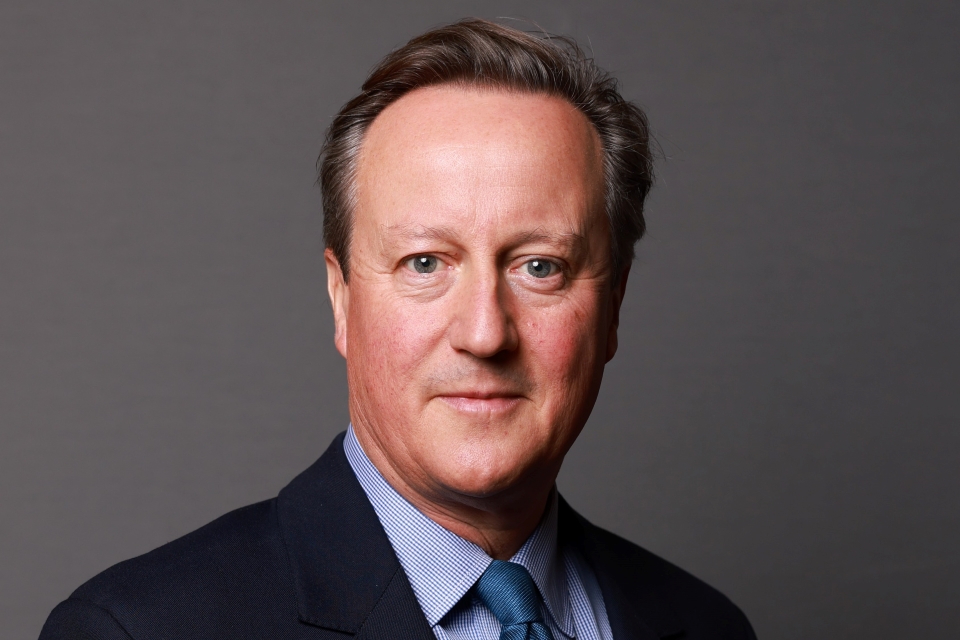

Speech to The Times CEO Summit

A transcript of a speech given by the Prime Minister to The Times CEO Summit in London on 28 June 2010.

Prime Minister

Thank you very much for that introduction. You are right, I have just flown in from Toronto and so I forgive anyone who falls asleep during my speech as long as you don’t mind if I do the same thing.

There were some high points and low points at the G20; obviously one of the high points was the ultimate act of economy for a British Prime Minister which was to share a chopper ride with the President of the United States. Clearly the low point and the exquisite torture was watching England being thrashed by Germany in the company of Chancellor Merkel. I have to say, she is one of the politest people I have ever met; every time the German - or, as I kept pointing out to her, mostly Turkish and Polish - players managed to slip another one past our lads, she would turn to me and say, ‘I am really very sorry.’

As I sat around first that G8 table and then that G20 table, the question I was asking myself was not just whether Britain can continue to earn its place in these fora, but can we also make sure we continue to earn our voice. Are we going to be a serious economic and political and diplomatic player, are we going to be listened to, are we going to recover our economy from the state that it has been in?

For me, the essential question - and the question I want to try and answer tonight - is how will Britain earn its living and its place in the world in the future. I think there are too many people in this country who live under the delusion that a prosperous past guarantees a prosperous future, and you just spring back after a difficult time. It isn’t written anywhere that this country automatically deserves a place at the top table; it was once said that freedom once won is not won forever. It is like an insurance premium, each generation has to renew it. I think economic prosperity is the same; just because we have had it before doesn’t mean we will automatically get it again.

The world doesn’t owe us a living - I am sure that was one of the conclusions of your sessions today - Britain has to earn a living. The crisis that we find ourselves in means that we have got to rebuild our economy, and I profoundly believe that we can turn our economy around and we can be a real success story over the next few decades. Just as we broke ground in the past with supply-side reform, privatisation, the rebirth of enterprise and more competition, so we can break new economic ground today. Like before, we need a clear diagnosis of the problems we face and the courage to deal with them decisively, and it sounds like your five tests were a pretty clear and decisive break.

We can actually, I think, show some leadership in the world in tackling the problems that so many countries, particularly in Western Europe, all face together. I wanted to set out what I think are the three vital steps for doing that. First is - and my first is the same as your first - making government live within its means with a decisive plan to bring down the deficit. The second thing we have to do, though, is to make work pay with reform of the welfare and benefits system. Third, and crucially - and I think this comes up in a couple of your five - is that we have got to make sure Britain earns its way in the world once more, with a new drive to make Britain a magnet for investment and a new thrust to advance British commercial interests around the world.

I think these three steps can help Britain earn its living in the decades to come. Ever since it was said that we had lost an empire but not yet found a role there has been a lot anxiety about our future, about our declining place on the world stage and our diminishing fortunes. I believe, however, that decline is not inevitable; we have huge advantages - the English language, great universities, established industries, ingenuity, one of the most open economies in the world, fantastic talent - these are old advantages that we can renew again and I think there is another new one, which is a growing attitude across the country - particularly perhaps in business - that we are not just going to deal with these debts and fight for our survival, but we are going to build on it with success.

Now, let me just take the three points I made and make some points about them; living within our means, making work pay and selling Britain around the world again. Government living within its means: you know the scale of the problem, it was frightening actually sitting there at the G20 looking at all of those countries and recognising that, according to the IMF figures, the country with the biggest budget deficit in any of those countries is Britain at over 11%.

I think it is very important to take on directly those who say, ‘Wait,’ who say cutting the deficit is somehow an alternative to growth. That is just simply wrong; looking at it the other way round, could you imagine, if we spent more, that our economy would actually improve? It would probably tip us over the edge into a Greek-style situation. Put it another way; if you think, ‘What if we did nothing, what if we just didn’t accelerate the deficit plans?’ Again, I think we would be punished, and rightly so, by the markets with higher interest rates and less confidence.

It is not only that dealing with the deficit is essential for confidence which is essential for growth; if we do nothing, by the end of this parliament we would be spending £70 billion just on the interest on our debt. To put that into context of government spending, that is the whole of the schools budget for England, plus the whole of the transport budget for the United Kingdom, plus every single penny piece we spend on climate change. That is the same size as the interest bill we would be paying on our debt. So we have got to take on the people who say that fiscal consolidation is an alternative to growth; it is actually part of getting confidence that gets growth.

I also think we have to take on those who argue that dealing with the deficit has to be unalloyed misery. Now, of course it is going to take difficult decisions, of course there will be painful decisions and we have taken some of those in the Budget, but I think it is important that we, as a political team, approach this task not as a bunch of hatchet-faced accountants - and let me say, some of my best friends are accountants - but actually as people who want to reform.

So if you just consider a couple of facts: if productivity growth in the public sector in the last decade had been the same as productivity growth in the private sector, our public services would cost us £60 billion less. That would go a huge way to dealing with the problem. Take another fact: if you, in fulfilling one of your objectives, go for a choice and competition-driven model for schooling, you can make huge steps forward. In Sweden, they employ 300 people in their Department of Education - we have thousands - which even has higher standards and higher results. Reform also should mean making sure there are no places where payment by results and reform are not prepared to go.

Let me give you another fact: every prison place in this country costs £45,000 a year and, on average, 40% of prisoners leaving prison are back in again within a year. Now, think of that in business: imagine if one of your subsidiaries came to you and said, ‘Well, I have got this great business, every unit we produce costs £45,000, but within a year 40% of them are defective.’ It is a completely unacceptable situation and one where reformers need to get to grips with what we are doing.

What is interesting is everyone is watching all of the countries who have to deal with this massive fiscal crisis, and I want us to be one of the countries that people look at in future years and say, ‘Yes, they did it, they understood what needed to be done to get more for less in public services to deal with their debts.’ I think there is an opportunity for Britain here; the European Union has got huge problems with the Euro, in the US there is still some debate about stimulus and any debt reduction package will be tough to get through Congress. We can actually take a leading role in trying to demonstrate how this can be done, done well, done decently and done fairly.

Second issue: how do we make work pay? All of you in your annual reports and in your businesses always use that phrase about the greatest resource you have is your people. Well, that is actually true for a modern industrial country as a whole; one day there won’t be so much North Sea oil, so much North Sea gas, we will have to do more in terms of relying on the ingenuity and brilliance of our people. But look at our record. Today, eight million people in Britain of working age are economically inactive, five million people are on out-of-work benefits and, as a social consequence of this, one in six children is growing up in a household where nobody works.

So this is not just a question of maximising our GDP by getting more people off welfare and into work, it is also the answer to the question, ‘How do we pay for good public services? How do we pay for our future pension liabilities?’

Today, quite rightly, we have set out a new approach on immigration; immigration has been too high in this country, it needs to be brought under control, and having controls and having a cap I think is a thoroughly good idea. But the real long-term answer to immigration is actually to reduce the demand for immigration by means of which you actually reform welfare and get people off welfare and into work. I think this is a huge agenda of making work pay. We have already raised the tax thresholds, we have already taken some families out of the tax credits system, and we are going to have a big thrust on reforming welfare and getting people back to work, by having a system where we do give genuine tailored help and support to people who are stuck on welfare, but in return for that, if you are offered a job that you can do, and you choose not to, you cannot go on receiving benefits.

Let me just address the third question: how do we help to earn our way in the world? I do sometimes sense when I look at how we deal with international relations in terms of trade and trade promotion that we are playing softball while the rest of the world is playing hardball. Let me just give you one figure which I asked for. I went to see the Crown Prince of Abu Dhabi, and I flew over the UAE and saw some of the extraordinary growth that is taking place in that economy, and we all know the problems, but I asked for the figures just to see what has happened over the last decade. A decade ago, we had 8% of their market, the same as China. Today, ten years later, we have 4%, and China has 16%.

If you take just that one example of a high-growth economy where Britain has got a fantastic set of relationships, historical connections, great coordination between governments, armed forces, a huge amount of exchange of people, and yet our performance is like that. We export more to Ireland than we do to Brazil, Russia, India, and China combined. In India, somewhere where we have historic links and fantastic business opportunities, we have gone from 4th to 18th in terms of their imports. I really believe there is an opportunity for a new government at the bottom of an economic cycle, beginning to grow out of it, with an enthusiastic team of ministers to completely refocus our trade and our diplomatic effort to turn it more towards South East Asia, to turn it more towards Gulf countries where we have such opportunities.

I have set up this National Security Council, which is mostly about making sure our foreign policy and our security policy march hand in hand. At the same time, it does have economic ministers on it as well, because part of our security is our economic security. When we are thinking of our relationships, whether with Russia, or China, or India, we should be thinking about the economic relationship in a way that is much more focused than it has been in the past.

Let me just end with a couple of other thoughts on this. We have slipped to 86th in the world league for regulation. In terms of tax - one of your highest priorities - one of the things I was proud George Osborne was able to do in the Budget was to set out annual cuts of one pence every year to get us down to a 24p corporation tax. There aren’t many things where global competition is so clear and so obvious, but it seems to me an advertisement for your country, a commercial for your country, if everywhere you go, you can point out that coming to invest in Britain and you will be left with one of the lowest tax rates anywhere in the G8 or the G20.

So, what I want to say to you tonight before trying to answer your questions is: I don’t think we should necessarily say there is a great opportunity, because we have massive challenges to meet in reducing the deficit, in making work pay, in getting Britain to earn its way in the world, but it is a challenge that we should be excited about meeting. Because I think if we can show that you can get a deficit from 11% back down to zero, if you can show that work pays, and you are not going to have a country where 5 million people live on out-of-work benefits, and if you can show that in some of those key markets where Britain knows it can succeed, like India, like China, like the Gulf, you are going to have a renewed effort, a renewed focus, and get Britain making things and exporting things again.

I think if you can do those things, when you sit at that table at the G8 or the G20, or when you try and sell your goods or your services anywhere in the world, you can do so with a pride that Britain is back in business, back sorting out its problems, back giving an example to the world of what proper, good, decent, responsible government looks like in 2010. All I can say after 50 days of trying to do this job: it’s an incredible privilege to have that opportunity. Thank you.

I am very happy to take some questions. I will try and give shorter answers than the speech.

Question

I was struck by the international aspects of your speech, but also the importance of industry in getting the economy going again, and working in the energy field I think there may be a combination of three things that are particularly important and may spell opportunity. One is energy security for the UK - you mentioned North Sea oil and gas - for the UK and internationally; two is tackling climate change; and three is a set of technologies that are required for doing that. I think those technologies may spell opportunity for British businesses. I wondered if you had a view about how we can organise ourselves effectively to identify the most important technologies. I think there are some things that Britain is particularly good at. Nations can identify their comparative advantage, and companies can identify their comparative advantage. How can we set ourselves up to realise the opportunities, both as a nation and as companies?

Prime Minister

I think there are huge opportunities. I saw the Indian Trade Minister, who is in town today, and he was actually asking specifically: ‘We are investing in India now,’ he said, ‘in some green technologies, and we want to know who to partner with in Britain, because you are our partner of choice.’ I think the opportunities are huge. We have also got a massive domestic opportunity, because we have got the universities - particularly Edinburgh and Bristol - who are leading in research on carbon capture and storage. We have got untapped reserves of coal. We have got coal-fired power stations that need to be fitted with CCS, and we have got the whole of the depleted North Sea to offer carbon capture and storage, not just for our own industry, but also for the whole of northern Europe.

I agree with you that the worksheet you have given me on energy security, climate change and technologies, and partnering with other countries is absolutely where we need to be. I think the new Department of Energy and Climate Change works. I know it is small, and I know it has a relatively small budget, but it has got, actually, in Chris Huhne, Greg Barker and Charles Hendry - it has got three very talented ministers.

Charles Hendry knows probably more about carbon capture and storage than anyone else in politics. I am going to try to do something that previous governments have failed in, which is actually to find a good energy minister and then keep him there for a period of longer than, let’s say, three years. I think we have had twelve energy ministers over the last decade, endless papers and strategies, but no consistency. I think there is a real opportunity to work with the big players we have in this industry to take the opportunities that you speak about.

Question

I agreed with many of things that you said were great about Britain and what it had to offer the world, the English language, etc. I wondered what you thought about the rule of law in that package. Given your inheritance, given the concerns about compromises for the rule of law in recent years, how do you think that fits in to the package for people from industry who are here today and tonight, and given Britain’s prospect in the wider world in the future?

Prime Minister

Even, or maybe particularly, on the subject I am talking about, which is how we succeed economically, I think it is fantastically important. One of the reasons why so many businesses locate here, so many people want to do business here, so many companies, whether they are Indian, or Russian, or wherever, come and list here, is because we have the rule of law consistently applied, and we have a good legal system. It is extremely important as one of things that makes the UK an attractive destination. It is definitely true, as we try and seek out markets overseas - you do find a lot that some very exciting opportunities in markets are much less exciting when you look at the chaotic state of their commercial law, and the complete inconsistency with which it is applied.

One of the reasons why a lot of business people say to me that we should have a particular emphasis on India is although it has very complex legal systems, it does have some basic rule of law and the backup of democracy, and a good and decent government in place, and that is why I have talked about a special relationship with India and singled them out, because I think it is one of the fastest growing economies, one of the greatest opportunities for the country, and actually a place where I think there is more certainty in doing business than in many of the other markets. So yes, it is important.

Question

Prime Minister, one of the big debates that emerged at the summit, as you will know better than I do, is about how quickly to cut deficits and we had the spectacle of Britain and many leading European countries cutting deficits, planning to cut deficits very fast, as everyone in this room has encouraged you to do. And yet we have had President Obama expressing concern about that and I wondered whether you felt that you’d managed to persuade him that Britain and the rest of Europe were doing the right thing, whether he was doing the right thing for America or whether he was wrong.

Prime Minister

I had quite long conversations with him about this precisely and he accepts that Britain has a particular need to go quite fast. As I said, if you look at the IMF figures, our deficit at over 11% according the IMF is actually higher than the US deficit and, of course, we are not a reserve currency, so we don’t have the luxury of hanging around. But I think there is a slight misunderstanding about the whole of the G20 and what it was actually about.

The whole of the G20 this time is about an approach recommended by the IMF, which is to try and achieve the maximum possible level of world growth. And what the IMF recommend is basically three things that everyone needs to address. The first is deficit reduction in those countries that most need it, and when you ask who most needs it, it’s undoubtedly clear that it’s countries like Spain and like Britain. The second thing is to address the imbalances in developing countries like, for instance, China, and you saw before the G20 the gentle appreciation of the RMB, which is going to make a difference; not as much as we would like, but it’s going to make a difference. The third thing is that advanced countries in the West should be restructuring their economy to make them more growth-friendly. Now, whether that is Germany having Sunday trading or Britain making sure our labour market is more competitive or whatever, those are all steps that should be taken.

And what the IMF are saying is that if you have a deficit problem then dealing with that deficit is part of getting good, high levels of world growth. And that’s why I say there isn’t a contradiction. I think these people who try and say that you can either have deficit reduction or you can have economic growth are profoundly wrong. In order to get the maximum level of world growth you need those countries with a deficit problem to deal with their deficits. And one of the things that changed before the G20 summit was the sovereign-debt crisis in Europe, which put into sharp relief the need for countries like Spain, like Britain, like France, like others to take action on their deficits. Timing and speed should be a matter of your own national appreciation of how bad your problem is.

I thought that Schauble wrote a brilliant article in the FT pointing out that Germany is actually still going to be expanding fiscally in 2010 and part of 2011 and the brakes only go on later - later, indeed, you could argue, than in the US. Whereas Britain, where, as I say, an 11% deficit, it was important, I believe, to take a step in the current year to show that we were taking action. And to argue, as some do, that somehow a £6 billion saving in an economy of a trillion is somehow going to be a decisive change to the economy, it’s certainly a decisive change to get to start on the deficit, but to say it’s a decisive change to the economy I think is wrong.

So, fundamentally, I don’t believe there was this great disagreement at the G20. There’s a difference of speed and pace for different countries, but there’s a basic acceptance that those three things need to go together. And I think President Obama’s greatest goal was to try and put some pressure on the surplus nations to take action, to put something into the pot to get more growth out.

The one area where there’s a difference of view between Britain and America, although I thought there was some good progress, is on the issue of world trade. The greatest stimulus we could all have is a completion of the Doha Round and more trade around the world and what was interesting was that the Americans are prepared to make some move on this if the Round can be opened up and more can be added into it and I think that should be a major goal for Britain. Even if we don’t get it this year, even if we don’t succeed, let’s go to all of these conferences and always bang the drum for free trade, for Doha, for adding to Doha, for trade facilitation, because as one of the most open economies in the world I think we can make that argument with real vigour.

Question

We have an amazing natural resource in the country in the shape of the skill base and the brains. We have a phenomenal science base in the country and yet many would argue that we fail to turn that incredible resource into economic prosperity and we have seen some of our brightest people leave and set up businesses in other parts of the world and create wealth.

Now, the new emphasis on rebalancing the economy and the need to promote know-how businesses is obviously a great step forward and we’ve seen some concrete policies to support that, but I’d be very interested in hearing what the next stage is in encouraging Britain to use its science base and its know-how and its creative industries to actually create some of the businesses which will become more and more important as the years move on.

Prime Minister

Well, as you know, we’ve met and spoken about this. I think it’s incredibly frustrating. We’ve got these brilliant universities, we’ve got an amazing record of invention and inventiveness. If you look at science papers published and all the rest of it, inventions and patents, we’re right up there, but are we turning them into the businesses? There is something missing. James Dyson did a very good report for us in opposition which we’re working on. I think it’s a range of different things and I won’t mention them all tonight, but I hope we can go on working together.

I think there is an element of Britain is a brilliant place if you want to float a new business or if you want to raise an enormous sum of money for a project. I’m not sure it’s a very good place for the £100,000, £200,000, £500,000 starter venture capital loan to start the small business that becomes larger. I think other countries seem to have cracked that better than us, so I think that is one area we can look at. But I’ve put David Willetts, one of my best and brightest, into this area to try and work out what it is that other universities are doing around the world that we’re not to actually convert brains into cash.

I’ve only got time for one more question if there is one. Sir?

Question

Prime Minister, I think there are two things which have made Britain less competitive. One is the tax regime and I think we all hugely welcome both the substance and the atmosphere behind what the Chancellor has been saying about the tax regime. The other is regulation and while I can see a decisive change on the tax front and welcome very much the change in the attitude towards the deficit and moving away from never never economics, that on the regulation side we still seem to be following almost the personal agenda of ministers who are past. I wondered if there were any plans for making some kind of at least symbolic gestures which say we are actually going to make the regulation burden less for business.

Prime Minister

Yes, there are. Vince Cable, who I think will be an enormously effective Trade Secretary, has got two thoughts which I think will make a difference. One is this ‘one in, one out’ rule, that no one can introduce a regulation until they have scrapped one, and I think that will just put pressure on ministers to start looking through their departments and actually asking instead of ‘what more can I do?’, actually ‘what things am I currently doing that I shouldn’t be doing?’ And also, this idea of regulatory budgets. That if you add up the cost of regulations imposed by each department and then say, ‘Right, you’ve got to reduce the cost of those regulations year by year’. Those two ideas will make a difference, but it’s definitely tougher.

Cutting taxes is easier than cutting regulations, because all the pressure in a modern society pushes you towards regulation and that’s why I’ve brought back - always the ambition of every Conservative Prime Minister to bring something back - I’ve brought back Lord Young, who was, I think, actually enormously effective, David Young, in this area. And he’s drawing up a whole set of things we can do on the whole area of health and safety and litigation, which is actually what adds a lot to businesses and also creates a lot of the general [indistinct] factor. I think he will come up. I know some of his ideas he is going to bring forward which I think will make a difference. But it’s definitely harder to do.

We’ve crept up the league table, now 86th in the world for the extent of our regulation and that is simply not good enough. Part of it is a different mentality in government, where you’re asking instead of ‘what can the government do to solve this problem?’ actually asking ‘what’s business doing? What’s civil society doing? What solutions are working elsewhere that cost less?’ It’s a different mental attitude which, given the state of the public finances, we’d have to do anyway, but I think actually this team of ministers is well placed to do.

Can I thank The Times and James Harding for having you all here today? It sounds like you’ve come up with some interesting ideas. I’m looking forward to getting the full set of conclusions and reading what you decided, but I think the set of agenda items you have without any forewarning was pretty close to what I’m recommending and, as I say, I want to work with you all in delivering what I think can be a very exciting time for our country. Tough times, difficult decisions have to be taken, but recovering from that and being a beacon to the world about how to cut deficits, how to deal with welfare, how to pay for your way in the world - a great and exciting agenda.

Thank you.