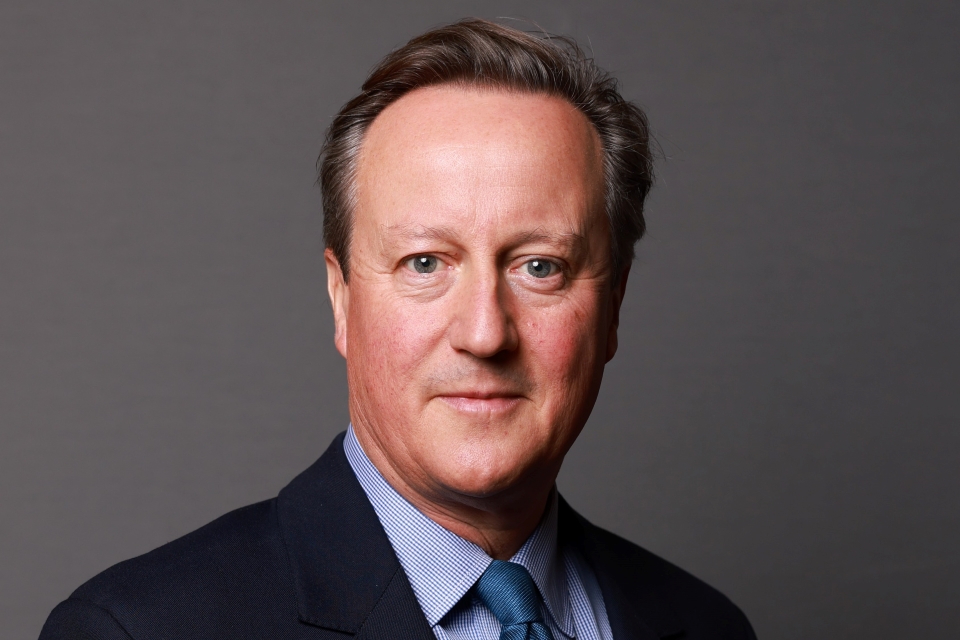

Welfare speech

"In a world of fierce competitiveness - a world where no-one is owed a living - we need to have a welfare system that the country can properly afford."

Speech by Prime Minister David Cameron on welfare, at Bluewater, Kent on Monday 25th June, 2012.

Prime Minister

On my first night as Prime Minister, I said we would build a more responsible society.

Where we back those who work hard and do the right thing.

Where we look after the elderly and frail.

Where - as I put it - those who can, should; and those who can’t, we will always help.

Building that society is simply not possible without radically reforming welfare.

Today, almost one pound in every three spent by the Government goes on welfare.

In a world of fierce competitiveness - a world where no-one is owed a living - we need to have a welfare system that the country can properly afford.

The system we inherited was not only unaffordable.

It also trapped people in poverty and encouraged irresponsibility.

So we set to work.

In two years, Iain Duncan Smith has driven forward welfare reform on a scale and with a determination not seen since World War Two.

He is a great, reforming Minister, with a passion and commitment that shine through.

And he is delivering remarkable results:

Over 400,000 more people in work than in 2010.

Tens of thousands of claimants of incapacity benefits re-assessed, and found ready for work.

We’ve established the biggest-ever Work Programme - and we’re well on our way to getting 100,000 people into jobs.

We’ve helped tens of thousands of young people find real work experience.

Reformed and reduced the extent of tax credits. Tightened up housing allowances.

Capped benefits so that in general, no one can claim more than the average family earns.

And we’ve laid the foundation for Universal Credit.

This has the potential to be one of the most significant reforms for a generation.

Ending the nonsense of paying people more to stay at home than to get a job - and finally making sure that work really pays.

What Iain Duncan Smith has achieved over the past two years.

Refusing to accept the status quo, turning around huge numbers of lives is truly remarkable.

But the job we have set ourselves, of building a welfare system that truly works - that supports the responsible society - that job is not yet complete.

So today I want to talk not just about what we’ve done, but where we go from here.

Benefits for the elderly and disabled

There are three component parts of the welfare system.

First there are benefits for the elderly.

These account for around £110 billion of the total welfare bill - the lion’s share of which is spent on pensions.

One very important value should sit at the heart of our pension system.

If you have worked hard all your life, then you deserve real dignity and security in your old age.

That’s why we restored the link between pensions and earnings - and ensured through the triple-lock that pensions would rise according to whichever was highest: earnings; inflation; or 2.5 per cent.

It’s why back in April we delivered the biggest-ever cash rise in the full basic state pension - an extra £5.30 a week.

And it’s why we’re bringing in the single-tier pension.

This means that instead of a complicated pension with endless top-ups, there will be a straightforward, flat rate of around £140 a week.

This act of simplification is incredibly important.

It’s going to pull hundreds of thousands out of means-testing.

It’s going to help make saving pay.

And it’s going to give pensioners more peace of mind, because they will have more clarity about what they’re going to get - and they can save for the future with greater confidence.

This is quite simply about doing the right thing by those who have done the right thing all their lives and I’m proud that we are the government taking this forward.

There is also a debate about some of the extra benefits that pensioners can receive - and whether they should be means-tested.

On this I want to be very clear: two years ago I made a promise to the elderly of this country and I am keeping it.

I was elected on a mandate to protect those benefits - so that is what we have done.

Next, we’ve got disability benefits for those who aren’t receiving a pension, which account for almost £10 billion of the total welfare bill.

Again, this was an area in need of reform.

Over the past decade, the number claiming Disability Living Allowance as a whole shot up from 2.5 million to 3.2 million.

Two thirds of the DLA caseload have an award for life.

And incredibly, half of new claimants never had to provide medical evidence.

When you know, as I do, how much help genuinely disabled people need, then you can’t just ignore it when the system isn’t working properly.

On the one hand, it’s not right that someone can get more than £130-a-week DLA simply by filling out a bit of paper.

But on the other, it’s not right that those with serious disabilities have nightmare 38-page forms to fill in.

So we’re bringing in a system that’s fairer and simpler.

And crucially, we’re introducing proper, objective assessments, so that money goes to people who truly need it, with more for the severely disabled.

At the end of all this there will continue to be generous disability benefits - and rightly so.

Working age welfare

But it’s in the third component of welfare - working-age benefits - that the really big arguments for the future lie.

Partly because this accounts for a huge amount of money - around £84 billion a year.

But mainly because it’s here that things have gone truly awry.

We inherited, quite simply, a mess of perverse incentives, mind-numbing complexity and real unfairness.

Here are just a few examples of what’s possible in that system.

Take a couple living outside London.

He’s a hospital porter, she’s a care-worker.

They’re both working full-time and together they take home £24,000 after tax.

They’d love to start having children - and they know they’d get some help from the state if they did so.

But with the mortgage and the bills to pay, they feel they should keep saving up for a few more years.

But the couple down the road, who have four children, haven’t worked for a number of years.

Each week they get £112 in income support, £61 in child benefit, £217 in tax credits and £141 in housing benefit - more than £27,000 a year.

Even after the £26,000 benefit cap is introduced, they’ll still take home more than their neighbours who go out to work every day.

Can we really say that’s fair?

Next there’s the situation with young people who want to leave home.

Take two young women living on the same street in London.

One studied hard at college for three years and found herself a full-time job - say as a receptionist - on £18,000 a year, or about £1200 take-home pay a month.

She’d love to get her own place with a friend - but with high rents in her area, the petrol to get to work and all the bills, she just can’t afford it.

So she’s living at home with her mum and dad and is saving up desperately to move out.

Then there’s another woman living down the street.

She’s only 19 years-old and doesn’t have a job but is already living in a house with her friends.

How?

Because when she left college and went down to the Job Centre to sign on for Job Seeker’s Allowance, she found out that if she moved out of her parents’ place, she was automatically entitled to Housing Benefit.

So that’s exactly what she did.

Again, is this really fair?

And then there are the hundreds of thousands of commuters who travel long hours each day because they work in places like central London.

Places where they couldn’t possibly afford to rent or buy on the money they’re earning.

But at the same time, in those places where they’re working but can’t afford to live, there are people on salaries of £40, £60, £80,000 paying sub-market rents and living in council houses.

What these examples show is that we have, in some ways, created a welfare gap in this country between those living long-term in the welfare system and those outside it.

Those within it grow up with a series of expectations: you can have a home of your own, the state will support you whatever decisions you make, you will always be able to take out no matter what you put in.

This has sent out some incredibly damaging signals.

That it pays not to work.

That you are owed something for nothing.

It gave us millions of working-age people sitting at home on benefits even before the recession hit.

It created a culture of entitlement.

And it has led to huge resentment amongst those who pay into the system, because they feel that what they’re having to work hard for, others are getting without having to put in the effort.

The system is saying to these people:

Can’t afford to have another child? Tough, save up.

Can’t afford a home of your own? Tough, live with your parents.

Don’t like the hours you’re working? Tough, that’s just life.

So there is a real welfare gap that exists in our country.

How we got here

Now when we look at how we got into this mess, we can go back in time and see a lot of good intentions.

Why does the single mother get the council house straightaway when the hard-working couple have been waiting for years?

Because governments and local councils wanted to make sure children got a decent start in life, so mothers were given priority for council housing.

Why do we have people on big salaries living in council houses?

Because governments wanted social housing to support hard-working people, so the eligibility criteria were set wide and the tenures long.

Why has it become acceptable for many people to choose a life on benefits?

Because governments wanted to give people dignity while they are unemployed - and while this is clearly important, it led us to the wrong places.

To job seekers being called ‘customers’ instead of claimants and to conditionality on benefits being set at the bare minimum.

As well as the good intentions of governments, there was that assumption of trust at the heart of the system.

That people would naturally do the right thing.

That they would use the system when they fell on hard times but then work their way out of it.

This may have worked when the welfare state was born, when there was a stronger culture of collective responsibility in this country.

But as I’ve argued for years, the welfare system has helped to erode that culture.

From the couple told they’ll get more benefits if they live apart, to those who knew they could earn more by signing on than by going out to work.

Time and again people were not just allowed to do the wrong thing, but were actively encouraged to do so.

How we get out

That’s how we got here.

How do we get out?

Some say the answer is more money.

The argument goes that if you give more welfare money to those who are higher up the income scale as well as those at the bottom then you iron out the perverse incentives that encouraged people not to work, not to save, not to do the right thing.

Indeed, that’s part of the thinking behind Universal Credit - it’s about helping more people to escape the poverty trap and get on in life.

But anyone thinking we can just keep endlessly pumping money in is wrong.

Frankly, to quote the last government, there is no money left.

We’re already spending one pound in eight on working-age welfare - twice as much as we spend on defence.

The truth is we can’t just throw money at the problem and paper over the cracks.

The time has come to go back to first principles; to have a real national debate and ask some fundamental, searching questions about working-age welfare.

What it is actually for.

Who should receive it.

What the limits of state provision should be and what kind of contribution we should expect from those receiving benefits.

Let me take each in turn.

As I do so I want to stress now that these are not policy prescriptions; they are questions that we as a country need to ask in a sensible national debate.

What working-age welfare is for

First, let’s be clear what working-age welfare is for.

More than anything else, it is about providing a safety net.

You fall into it if times are hard, and it helps you back out again.

[political content excised]

It’s what the Deputy Prime Minister has rightly called the poverty plus a pound approach: push people one pound over the poverty line and consider the job done.

As Iain Duncan Smith has argued so powerfully, that might look good on the government spreadsheet but it means next to nothing on the ground.

Crucially, it doesn’t address the causes of poverty.

You can give a drug addict more money in benefits, but that’s unlikely to help them out of poverty; indeed it could perpetuate their addiction.

You can pump more cash into chaotic homes, but if the parents are still neglectful and the kids are still playing truant, they’re going to stay poor in the most important senses of the word.

So this government is challenging the old narrow view that the key to beating poverty is simply income re-distribution.

Of course money is vital.

That’s why we’ve increased child tax credits for the poorest families.

But our argument - and our approach - has two important parts.

First, we must treat the causes of poverty at their source…

…whether that’s debt, family break-down, educational failure or addiction…

Second, we’ve got to recognise that in the end, the only thing that really beats poverty, long-term, is work.

We cannot emphasise this enough.

Compassion isn’t measured out in benefit cheques - it’s in the chances you give people…

…the chance to get a job, to get on, to get that sense of achievement that only comes from doing a hard day’s work for a proper day’s pay.

That’s what our reforms are all about.

Transforming lives. Helping people walk taller.

Attacking the complacent, patronising view that said all millions of working-age people were good for was receiving from the state.

And saying: no - self-reliance is in everyone. Industry is in everyone. Aspiration is in everyone. No-one is a write-off.

That’s why getting people into jobs is central to our vision for making this country stronger and we need to keep building a system that delivers this vision.

Yes, a genuine safety net for those who need it but also a strong minimum wage to draw people into work and prevent exploitation.

And crucially, a tax system and tax credits so that people are incentivised to work.

Who should receive

This is the vision for working-age welfare and it follows from this that we need to think harder about who receives it.

If it is a real safety net, then clearly it’s principally for people who have no other means of support, or who have fallen on hard times.

But there are many receiving today who do not necessarily fall into these camps.

For example, the state spends almost £2billion a year on housing benefit for under-25s.

There are currently 210,000 people aged 16-24 who are social housing tenants.

Some of these young people will genuinely have nowhere else to live - but many will.

And this is happening when there is a growing phenomenon of young people living with their parents into their 30s because they can’t afford their own place - almost 3 million between the ages of 20 and 34.

So for literally millions, the passage to independence is several years living in their childhood bedroom as they save up to move out.

While for many others, it’s a trip to the council where they can get housing benefit at 18 or 19 - even if they’re not actively seeking work.

Again, I want to stress that a lot of these young people will genuinely need a roof over their head.

Like those leaving foster care, or those with a terrible, destructive home life and we must always be there for them.

But there are many who will have a parental home and somewhere to stay - they just want more independence.

The point is this: the system we inherited encourages them to grab that independence, rather than earn it.

Perversely, the benefits system encourages this process from one generation to the next.

If a family living on benefits wants their adult child to stay living at home they are actually penalised - as soon as that child does the right thing and goes out to work.

You get what’s called a non-dependent deduction, removing up to £74 off your housing benefit each week.

I had a heartrending letter from a lady in my constituency a few weeks ago who said that when her son leaves college next month, her housing benefit will drop significantly, meaning her family may have to split up.

This doesn’t seem right.

In effect, the state doesn’t just open a door to dependency for young people, it drags them in.

And this marks us out from many other countries in Europe, where the emphasis on family responsibility is much stronger.

In Holland, for instance, the welfare system doesn’t provide for under-21s as a default - and where it does, it expects their family to contribute if they can.

So if they’re on means-tested benefit and are getting about 230 Euros a month, it’s usually for their parents to top that up.

And compared to here, the qualifying criteria for young people to get financial help with housing are much tighter.

So we have to ask: up to what age should we expect people to be living at home?

Another question has to be asked about those on high salaries in social housing.

Today there are between 12,000 and 34,000 households with incomes of over £60,000 living in council houses.

Between 1,000 and 6,000 council house occupants earn over £100,000.

This is a difficult area.

We don’t want to stop people striving and climbing up the ladder in case they lose their home.

But when you have people on £70,000 a year living for £90 or so a week in London’s most expensive postcodes you have to ask whether this is the best use of public resources.

Every pound that is used to subsidise those rents effectively comes from someone else’s wages.

So this is another area for debate: who should be entitled to have their own home, funded by the state?

The limits of state provision

Next, we need a debate about the limits of state provision.

There are national questions we have to ask.

This year we increased benefits by 5.2 per cent.

That was in line with the inflation rate last September.

But it was almost twice as much as the average wage increase.

Given that so many working people are struggling to make ends meet we have to ask whether this is the right approach.

It might be better to link benefits to prices unless wages have slowed - in which case they could be linked to wages.

There are a number of options we could look at.

There’s also a whole debate about how long the state should provide at a particular rate.

Back in the 90s the Clinton administration in the US started time-limiting benefits, and they saw federal case-loads fall by over 50 per cent.

Instead of US-style time-limits - which remove entitlements altogether - we could perhaps revise the levels of benefits people receive if they are out of work for literally years on end.

It is extraordinary that there are 1.4 million people in this country who have been out of work for at least nine of the past 10 years.

So softer time-limits - that increase the incentive to work, that stop people getting stuck in that welfare trap - could be something we consider.

I don’t deny that these are big, tough questions.

But when you have got 300,000 children living in households where no one has ever worked, then you cannot shy away from them any longer.

As well as these general questions about the limits of state provision, we need to look at specific benefits.

Housing benefit is one of them.

The benefit cap is going to put a stop to the most outrageous cases.

The families getting £80, £90, £100,000 a year to live in homes that most people who pay the taxes towards those benefits could not possibly afford.

But still, there are questions about whether some people in some places are receiving too much, particularly given the hard times we’re in.

People can still seek support for housing up to a rate of £20,000 a year - that’s actually over 25 per cent higher than the average rent paid in London.

Just think what that figure means.

What would someone in work have to be earning to afford rent of £20,000 a year?

If rent is typically about a third of post-tax income, they’d have to be on a salary of at least £80,000.

That is in the top five per cent of the population.

Surely we should ask if it’s fair that the maximum amount that you can get on housing benefit is set at a level that only the top five per cent of earners would otherwise be able to afford.

Meanwhile those who work in expensive postcodes who aren’t on benefits typically have to move further out and commute in to work.

So this is a question that needs to be asked: should those on benefits be financially helped to live exactly where they want to?

And when talking about state provision and its limits, there is another area we need to look at and that is the interaction of the benefit system with the choices people make about having a family.

I’ve already talked about how many people have to think very carefully about whether they can afford to have children and how many they could have.

But let’s look at the signals that the welfare system sends out.

If you are a single parent living outside London - if you have four children and you’re renting a house on housing benefit - then you can claim almost £25,000 a year.

That is more than the average take-home pay of a farm worker and nursery nurse put together.

Or let me put this another way.

For most in work when they have a child their income will change very little but for many on out-of work benefits, their income will change substantially.

That is a fundamental difference.

And it’s not a marginal point.

There are more than 150,000 people who have been claiming Income Support for over a year who have 3 or more children and 57,000 who have 4 or more children.

The bigger picture is that today, one in six children in Britain is living in a workless household - one of the highest rates in Europe.

Quite simply, we have been encouraging working-age people to have children and not work, when we should be enabling working-age people to work and have children.

So it’s time we asked some serious questions about the signals we send out through the benefits system.

Yes, this is difficult territory.

But at a time when so many people are struggling, isn’t it right that we ask whether those in the welfare system are faced with the same kinds of decisions that working people have to wrestle with when they have a child?

The contribution we should expect

The last area for debate is about what we should expect from those receiving benefits.

For example, it is still possible to stay on benefits for years without gaining basic literacy and numeracy skills.

But isn’t this something we should expect of people, considering these skills are almost essential to getting work?

Bizarrely there is also no requirement to have a CV.

But shouldn’t this be the very thing that’s asked of people before they even walk into the job-centre?

And we have yet to introduce a system whereby after a certain period on benefits, everyone who was physically able to would be expected to do some form of full-time work helping the community, like tidying up the local park.

But wouldn’t this be a perfectly reasonable thing to expect?

In Australia robust, rigorous activity such as ‘work for the dole’ is standard after just six months.

For those on sickness benefits too, it might be reasonable for them to take more steps to improve their health.

Today if someone is signed off work with a bad back there’s no requirement to take steps to get well to keep on receiving that benefit - even if they could be getting free physiotherapy to get back to health and start working again.

And we also need to ask if single parents living on benefits can do more to prepare for work.

Today, we have 580,000 lone parents on out-of-work Income Support.

Before this Government came to office, single parents weren’t required to look for work until their youngest child was seven years old - up to three years after they’ve started primary school.

We thought that needed changing - so we’re bringing it down to five years-old, about the age they start school.

But now there is free childcare for all children from age three, that does prompt a question about how some of that time - 15 hours a week, more than a thousand hours over a couple of years - should be used by parents on Income Support.

Of course this is hard.

If you’ve got a small child in nursery for three hours in the morning then I’m not suggesting you’d be able to get them there, get home, get to work, do a shift then pick them up again.

Childcare can be incredibly awkward.

Sometimes the hours just don’t fit.

But even if there’s no scope for actually working, there should at least be for preparing to work: getting down to the job centre; writing a CV; learning new skills.

The current commitment - which is just to visit the Job Centre once every three months or every six months - does not seem to me to be enough, especially in the light of the free childcare that’s now there.

And in this debate about contribution, there is an argument to be made for recognising and rewarding those who have paid into the system for years.

Today we treat the man who’s never worked in the same way as the guy who’s worked twenty years in the local car plant, lost his job and now needs the safety net.

So here we could ask whether your reward for paying in is that you won’t have to face all the tough conditions that we’re imposing on those who haven’t paid anything into the system at all.

This is very simply about backing those who work hard and do the right thing.

Timing

So these are just some of the questions I think we need to have in this debate.

Some provocative; some obvious; some long overdue.

There’s a number of questions I haven’t addressed.

Like if it’s right that people continue to have the option of leaving school and going straight onto benefits, without ever having contributed to the system in any way.

Or if it’s right that we are paying non-contributory benefits to those people who don’t even live in this country.

Or if it’s right that we continue to pay the vast majority of welfare benefits in cash, rather than in benefits in kind, like free school meals.

But for all, there are broader questions about timing.

About whether, if they were to happen, these changes would be made in one go and affect existing recipients - what is called ‘the stock’.

Or whether it is right that these changes would just affect future recipients - or what is called the ‘flow’ - so people coming in to the system would know more clearly what is expected of them.

For now, both stock and flow options should be there on the table.

And there is also, more immediately, a question of timing about when these questions will be asked - in this Parliament or the next.

On some of them I hope to work with our coalition partners over the next few years.

[political content excised]

Conclusion

I said something else on the steps of Downing Street on my first night as Prime Minister.

That we would confront the problems that are holding Britain down and face up to the big challenges.

Those words are put to the test on welfare.

There are few more entrenched problems than our out-of-control welfare system and few more daunting challenges than reforming it.

Raising big questions on welfare, as I have today - it might not win the government support.

Frankly a lot of it might rub people up the wrong way.

But as I’ve argued, the reform of welfare isn’t some technocratic issue.

It’s not about high-level accounting to get the books in order.

It’s about the kind of country we want to be - who we back, who we reward, what we expect of people, the kind of signals we send to the next generation.

So no matter how tough it is, we are going to ask the big questions.

Because governing is not a popularity contest.

It’s about doing what is right for our country not just for today but for the long-term - and that is what we are determined to do.